All Categories

Featured

Table of Contents

Below is a theoretical comparison of historic efficiency of 401(K)/ S&P 500 and IUL. Allow's assume Mr. SP and Mr. IUL both had $100,000 to saved at the end of 1997. Mr. SP spent his 401(K) cash in S&P 500 index funds, while Mr. IUL's money was the cash money value in his IUL policy.

IUL's policy is 0 and the cap is 12%. Given that his cash was saved in a life insurance coverage policy, he doesn't require to pay tax obligation!

Wrl Iul

The numerous options can be mind boggling while researching your retired life investing choices. Nonetheless, there are particular choices that need to not be either/or. Life insurance policy pays a survivor benefit to your recipients if you ought to die while the policy is in result. If your household would deal with economic difficulty in the event of your death, life insurance coverage uses comfort.

It's not one of one of the most lucrative life insurance policy investment plans, yet it is one of the most safe. A form of permanent life insurance coverage, universal life insurance policy enables you to select just how much of your costs approaches your death benefit and how much goes into the plan to accumulate cash value.

Additionally, IULs allow insurance holders to take out fundings against their policy's cash money value without being taxed as revenue, though unpaid balances might undergo tax obligations and charges. The key advantage of an IUL plan is its potential for tax-deferred growth. This suggests that any type of revenues within the plan are not exhausted until they are taken out.

Alternatively, an IUL policy might not be the most ideal financial savings plan for some individuals, and a conventional 401(k) can confirm to be much more useful. Indexed Universal Life Insurance Policy (IUL) policies offer tax-deferred development possibility, defense from market slumps, and fatality advantages for beneficiaries. They permit insurance policy holders to gain passion based on the performance of a stock exchange index while protecting versus losses.

Max-funded Indexed Universal Life Vs 401(k) Plans

A 401(k) strategy is a popular retirement cost savings option that enables individuals to invest money pre-tax right into various financial investment devices such as common funds or ETFs. Companies may additionally provide matching contributions, further enhancing your retirement financial savings capacity. There are 2 main types of 401(k)s: typical and Roth. With a typical 401(k), you can reduce your taxable income for the year by adding pre-tax dollars from your income, while likewise taking advantage of tax-deferred development and employer matching contributions.

Several companies likewise supply matching contributions, effectively offering you free cash in the direction of your retirement. Roth 401(k)s feature in a similar way to their traditional counterparts yet with one trick difference: tax obligations on contributions are paid ahead of time as opposed to upon withdrawal during retirement years (top iul companies). This suggests that if you anticipate to be in a greater tax brace during retired life, adding to a Roth account could reduce taxes in time compared with spending exclusively via standard accounts (source)

With lower administration costs usually compared to IULs, these kinds of accounts enable investors to save cash over the long term while still gaining from tax-deferred growth capacity. Additionally, many preferred inexpensive index funds are readily available within these account types. Taking distributions prior to getting to age 59 from either an IUL plan's cash money worth by means of car loans or withdrawals from a typical 401(k) strategy can cause unfavorable tax obligation implications otherwise dealt with very carefully: While borrowing against your policy's cash value is generally taken into consideration tax-free approximately the amount paid in premiums, any type of unpaid loan balance at the time of fatality or policy surrender might undergo income taxes and penalties.

The Iul Vs 401(k): Making The Right Choice For Retirement

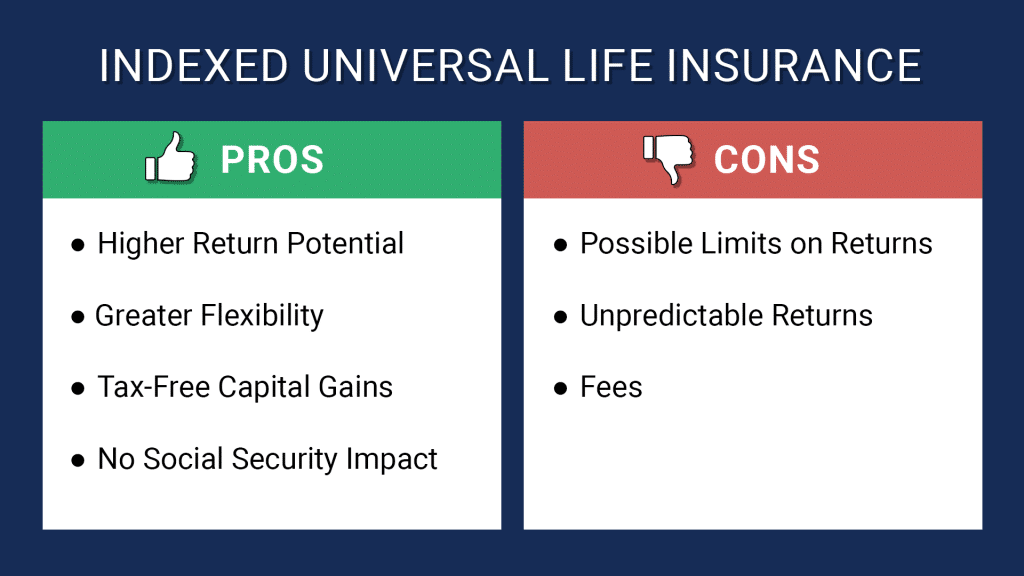

A 401(k) offers pre-tax investments, employer matching contributions, and potentially even more financial investment selections. Indexed universal life insurance or 401k. Seek advice from a monetary planner to identify the most effective option for your circumstance. The disadvantages of an IUL consist of greater administrative expenses compared to conventional retirement accounts, constraints in investment selections because of plan limitations, and possible caps on returns during strong market performances.

While IUL insurance might verify valuable to some, it's vital to understand just how it functions before purchasing a policy. Indexed universal life (IUL) insurance policy plans supply greater upside prospective, versatility, and tax-free gains.

As the index moves up or down, so does the price of return on the cash money value component of your plan. The insurance policy firm that provides the plan might use a minimal surefire rate of return.

Economists often advise having life insurance policy coverage that's comparable to 10 to 15 times your yearly earnings. There are several downsides connected with IUL insurance policy plans that critics fast to mention. A person that establishes the policy over a time when the market is executing badly could end up with high premium repayments that do not contribute at all to the money value.

In addition to that, remember the adhering to various other factors to consider: Insurance business can set participation rates for just how much of the index return you receive each year. Allow's state the plan has a 70% involvement rate. If the index expands by 10%, your cash value return would certainly be just 7% (10% x 70%)

Furthermore, returns on equity indexes are typically capped at an optimum quantity. A plan may say your optimum return is 10% annually, no matter just how well the index does. These restrictions can restrict the actual price of return that's attributed towards your account every year, despite how well the plan's underlying index performs.

North American Iul

IUL plans, on the various other hand, deal returns based on an index and have variable premiums over time.

There are numerous other sorts of life insurance policy policies, discussed listed below. supplies a set advantage if the insurance policy holder passes away within a set period of time, normally between 10 and three decades. This is just one of the most economical kinds of life insurance, in addition to the most basic, though there's no cash value build-up.

Iul Vs 401k Retirement Planning

The plan acquires value according to a fixed timetable, and there are less costs than an IUL plan. Nonetheless, they do not included the flexibility of changing premiums. includes much more flexibility than IUL insurance coverage, implying that it is additionally more challenging. A variable policy's money worth might depend upon the efficiency of certain stocks or various other safeties, and your premium can likewise change.

Latest Posts

Veterans Universal Life Insurance

Indexed Universal Life Unleashed

Whole Life Vs Iul